Editing the Cost Code Structure

In the Setup>Cost Code page you are able to append and modify your Cost Code Structure to best reflect your organisation’s activities.

You can make the following changes:

- Rename Parent Codes and Cost Codes

- Renumber Parents and Cost Codes (ie. change display/report order)

- Add new Parent Codes* and Cost Codes*

- Re-Parent Cost Codes* (move them to a different position in the hierarchy – only if they have no transactions recorded in prior-years)

- Delete Parent Codes* (only if they have no “child” Cost Codes)

- Delete Cost Codes* (only if they have no transactions recorded against them)

- Change Date From and Dates To* for Cost Codes (allows you to create different structures across financial years)

*Premium Accounts only

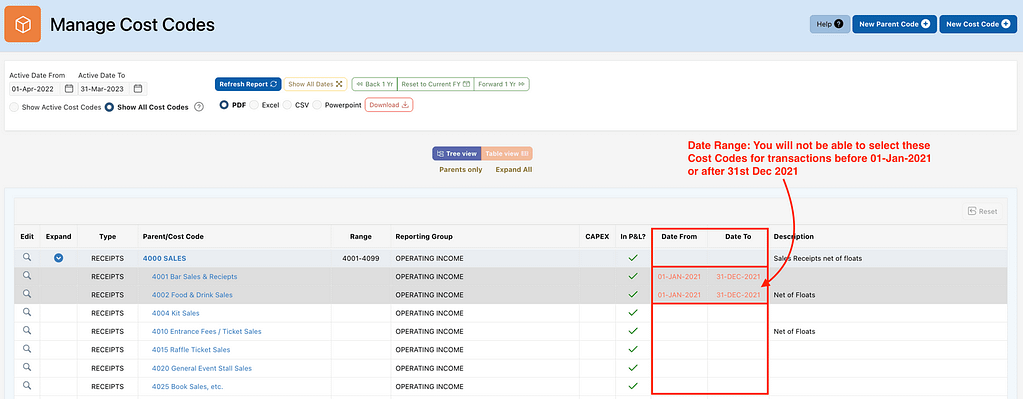

Cost Code Date Range

Cost Codes can have optional Date From and Date To values which you can use to control which Cost Codes can be selected when creating new Receipt and Payment transactions.

When you enter a Receipt or Payment transaction it will only allow you to select Cost Codes whose date range covers the Transaction Date. For example, your Receipt Transaction Date is “1-Jan-2019”. The available Cost Codes in the select list will not include any whose Date To is set to “31-Dec-2018” (or earlier)

When Editing Cost Codes you can choose whether to view all Cost Codes or filter those for the current Financial Year only.

This is useful if your organisation needs to change its Cost Code Structure when moving into a new Financial Year. Note that to preserve the integrity of your prior-year accounts, you cannot delete or change a Cost Code’s Parent if it has prior-year transactions charged to it.

But what if you wanted to move your “Membership Fees” Cost Code to a different Parent Code in your new Financial Year, say from “Sales” to “Other Income“?

In this example you would:

- Set the existing “Membership Fee” Cost Code Date To to the end of your last Financial Year to prevent it from being selected in the new Financial Year

- Create a new “Membership Fee” Cost Code under the “Other Income” Parent Code, and set its Date From to the first date of your new Financial Year.

When you enter a Receipt or Payment transaction it will only allow you to select Cost Codes whose date range spans the Transaction Date.

So, if your Receipt Transaction Date is “01-Jan-2019”, you will not be able to select Cost Codes whose:

- Date From is set to “02-Jan-2019” (or later) and/or

- Date To is set to “31-Dec-2018” (or earlier)

If you leave the Date From and Date To blank, the Cost Code can be selected for any Transaction Date.

When Editing Cost Codes you can choose whether to view all Cost Codes or filter those for the current Financial Year only.

Managing Cost Codes Tutorial

Click the “Full Screen” icon to expand. Space bar or Enter to move slides.