Premium Plus feature: This feature requires a Premium Plus subscription. Trial users have full access to this feature but please note you will need to subscribe to Premium Plus to continue using this after your trial period is over. Existing Premium users can request a new 30-Day trial period for this feature – please raise a Support Ticket.

About Report Groups

Report Groups allow you to create advanced Financial Statements and sector-specific report layouts that some organisations require. Report Groups are an additional Parent/Cost Code attribute that are used to determine where transaction values appear in reports which utilize Report Groups.

Report Group Sets

Report Group Sets determine which Report Groups and advanced Reports are available to your organisation.

Currently, the following Report Group Sets are available:

- Standard: select for non-charity, commercial organisations – provides access to the advanced Income Statement report.

- Scout: select for youth/scout groups that need to produce SORP style accounts

- Charity: select for charities that need to produce CC16 accounts

Report Groups

Each Report Group Set comes pre-populated with its own set of Report Groups.

Report Groups are used to determine the layout and structure of certain advanced Financial Statement reports (see below) and, by mapping Report Groups to your Cost Codes, they effectively create an alternative Cost Code hierarchy that can be used to give you more control over where transactions appear in the advanced reports.

Report Groups cannot be added or removed, however, you can rename them to better match your organisation’s Report requirements.

“Standard” Report Group Set

The Standard Report Group Set provides the following Report Groups which can be assigned to your Parent/Cost Codes. It currently provides a more advanced Income Statement (Profit and Loss) report layout required by larger commercial, non-charitable organisations.

The following Reports are available with the Standard Report Group Set:

- Income Statement (Standard Report Group)

Standard Report Groups*

- OPERATING_INCOME (Receipts) = Sales and revenues generated by your organisation’s core activities

- OTHER_INCOME (Receipts) = Other income received by your organisation, eg. Bank Interest Received

- COST_OF_SALES (Payments) = Costs and expenses incurred as direct result of your organisations core activities

- OPERATING_EXPENSES (Payments) = Other running costs and general overheads incurred by your organisation

- INTEREST (Payments) = Interest paid, eg. Bank charges

- TAXES (Payments) = Taxes paid, eg. Corporation Tax

- DIVIDENDS & DISTRIBUTIONS (Payments) = Distributions to owners or shareholders out of Net Profits

- CAPITAL_EXPENDITURE (Payments) = Capital Asset purchases using depreciation. Excluded from Profit & Loss Account

- INCOME EXCLUDED FROM PROFIT & LOSS (Receipts or Payments) = Receipts or Payments are not included in Profit and Loss Report

*All Standard Report Groups can be renamed

Advanced Income Statement Layout Example

Operating Income £20,000

Cost of Sales (£12,000)

—————————————————–

GROSS PROFIT £8,000

—————————————————–

Operating Expenses (£2,000)

Other Income £500

—————————————————–

PROFIT BEFORE INT & TAX £6,500

——————————————————

Interest Charges £0

Taxes (£1,000)

—————————————————–

NET PROFIT £5,500

—————————————————–

Dividends (£2,000)

—————————————————–

RETAINED EARNINGS £3,000

—————————————————–

“Scout” Report Group Set

The Scout Report Group Set is designed for Scouting and other youth group organisations that need to produce an income statement/profit and loss report by Fund type, following scouting group guidelines.

The following Reports are available with the Scout Report Group Set:

1. Charity Reports > Scout – Receipts & Payments by Fund Type Report

Scout Report Groups*

- RECEIPTS

- MEMBERSHIP_RECEIPTS

- INVESTMENT_INCOME

- DONATIONS_GRANTS_RECEIPTS

- ACTIVITIES_RECEIPTS

- FUND_RAISING_RECEIPTS

- OTHER_INCOME

- SUNDRY_RECEIPTS

- PAYMENTS

- MEMBERSHIP_PAYMENTS

- PREMISES

- DONATIONS_GRANTS_PAYMENTS

- ACTIVITIES_EXPENSES

- FUND_RAISING_EXPENSES

- ADMIN_EXPENSES

- LEGAL_EXPENSES

- OTHER_EXPENSES

- CAPITAL_PURCHASES_EXPENSE

- SUNDRY_PAYMENTS

- *All Scout Report Groups can be renamed

Scout – Receipts & Payments by Fund Type Report

Report Layout & Structure

| UNRESTRICTED FUNDs | RESTRICTED FUNDS | ENDOWMENT FUNDS | CURRENT YEAR | PRIOR YEAR | |

|---|---|---|---|---|---|

| RECEIPTS | |||||

| Membership Subscriptions | 7000 | 7000 | 6000 | ||

| Less Paid | (2000) | (2000) | (2000) | ||

| Total Membership Subscriptions | 5000 | 5000 | 4000 | ||

| Total Investment Income Received | 200 | 200 | 500 | ||

| Total Donations/ Grants Received | 200 | 1000 | 1200 | 0 | |

| Total Activities Income | 600 | 600 | 600 | ||

| Total Fund Raising | 1000 | 800 | 1800 | 500 | |

| Total Other Income | 200 | 200 | 100 | ||

| Total Sundry Income | 500 | 500 | 0 | ||

| TOTAL RECEIPTS | 7700 | 1800 | 9500 | 5700 | |

| PAYMENTS | |||||

| Total Premises Costs | 1900 | 1700 | |||

| Total Donations/Grants | 100 | ||||

| Total Activities Costs | 3100 | 3500 | |||

| Total Fund Raising Expenses | 200 | ||||

| Total Admin/Establishment Costs | 2000 | 2000 | |||

| Total Legal Expenses | |||||

| Total Other Expenses | |||||

| Total Capital Purchases | 1000 | ||||

| Total Sundry Payments | 100 | ||||

| TOTAL PAYMENTS | 7000 | 1200 | 9200 | 7400 | |

| SURPLUS DEFICIT | 700 | 600 | 1300 | 1700 |

“Charity” Report Group Set

The Charity Report Group Set addresses the requirements for Charity Commission (England and Wales) submissions and trustee annual Report, based on the widely recognized CC16 format.

What is CC16?

CC16 provides a simplified method for smaller charities to record cash inflows and outflows, crucial for fulfilling annual Report obligations.

CC16 Reports Available:

Navigate to Reports > Charity Reports and Financial Statements by Funds to access:

Charity CC16 – Section A – Receipts & Payments Report: A clear and concise summary of your charity’s income and expenditure.

Charity CC16 – Section B – Statement of Assets & Liabilities: A snapshot of your charity’s financial position at the end of the Report period.

Both reports are designed to mirror the Charity Commission’s official templates, offering “out-of-the-box” compliance. For detailed guidance on CC16 requirements, please refer to: https://www.gov.uk/guidance/prepare-a-charity-annual-return

Getting Started: Utilising Charity Report Groups

To leverage these reports effectively, your organisation needs to use the “Charity” Report Group Set. This allows you to categorise your Cost Codes for accurate mapping within the CC16 reports.

Here’s how:

Switch to the Charity Report Group Set:

- Go to Setup > Report Groups and select “Charity” from the Report Group Set dropdown.

- Important: switching Report Group Sets will overwrite existing assignments. Only one Group Set can be active at a time.

- Premium Plus Subscription Required: Report Groups are a feature of our Premium Plus subscription.

The Charity Report Group Set is structured into two sections:

- Section A: Receipts & Payments

- A1 Receipts: Includes Donations and Legacies (Grants, donations, fundraising income, legacies, and Gift Aid claims); Charitable Activities (Income from services, contracts, and fees related to the charity’s objectives); Other Trading Activities (Fundraising events, sponsorship, or sales of goods and services); Investment Income (Interest, dividends, or rental income from charity investments)

- A2 Asset & Investment Sales: Any income not covered above, such as asset sales or tax rebates

- A3 Payments: Includes Charitable Activities (Costs directly related to delivering the charity’s purposes e.g., grants, service delivery, project costs); Fundraising Costs (Expenses linked to raising funds, such as marketing and event costs); Governance Costs (Trustee expenses, legal fees, and administrative costs)

- A4 Asset & Investment Purchases: asset and investment purchases and expenditure not falling into the above categories.

- A5 Transfers between Funds: Transfers between Funds during the reporting period (Should balance to zero).

- A6 Cash Funds last year: Cash funds brought forward from previous year

- Section B: Statement of Assets and Liabilities

- B1 Cash Funds: Cash held at the bank and in hand at year-end. Includes balances in current accounts, savings accounts, and petty cash

- B2 Other Monetary Assets: Money owed to the charity (e.g., outstanding grants, loans, or Gift Aid claims)

- B3 Investment Assets: Market value of any investments the charity holds, such as stocks, bonds, or investment funds

- B4 Assets Retained for own use: Tangible fixed assets such as land, buildings, vehicles, and equipment. Includes valuation and description of major assets.

- B5 Liabilities: Amounts owed by the charity, including unpaid bills, loans, and grants payable.

Edit the Report Group labels

- The Section A – Receipts & Payments Report section values are derived from the following transaction sources in Clubtreasurer:

- A1 Receipts = operating income Cost Codes from Receipt transactions

- A2 Asset & Investment Sales = asset sales and investment income Cost Codes from Receipt transactions

- A3 Payments = operating expense Cost Codes from Payment transactions

- A4 Asset & Investment Purchases = asset and investment purchase Cost Codes from Payment transactions

- A5 Transfers between Funds = Fund Transfer and Account Transfer transactions

- A6 Cash Funds last year: calculated from last year’s values.

- You can use the Report Groups to define a custom reporting hierarchy for Sections A1 – A4 which can be used in the report instead of your existing Parent Code and Cost Code structures. This is useful if your organisation needs to report on a different basis than Parent/Cost Codes.

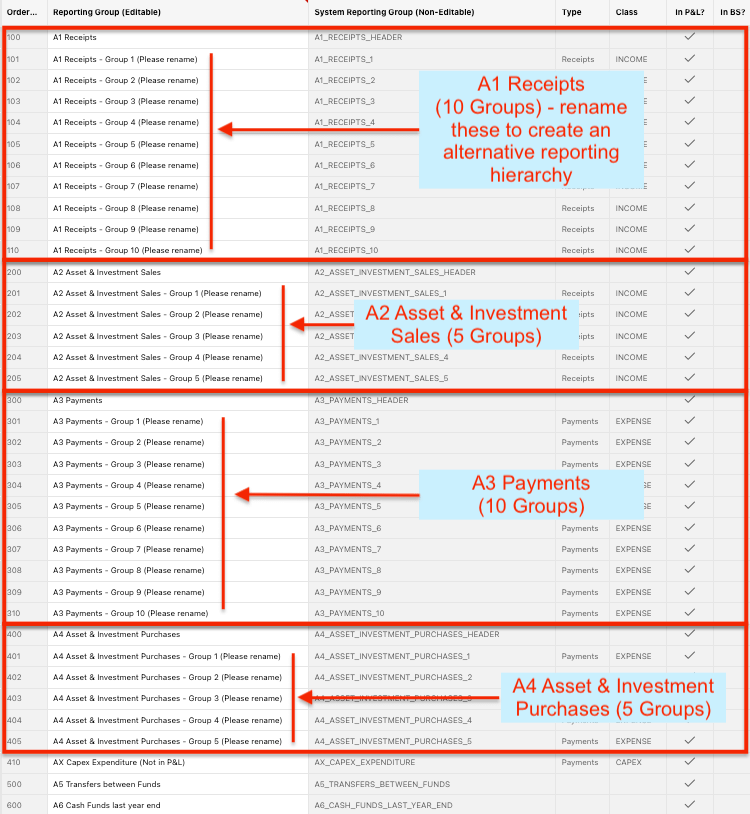

- To use the Report Groups you must rename the generic placeholder Groups in the table as follows. For each Section you can define either 5 or 10 custom Report Groups. See highlighted rows below:

For example, you could rename the Groups as follows:- A1 Receipts – Group 1 => “Membership Fees”

- A1 Receipts – Group 2 => “Fundraising Income”

- A1 Receipts – Group 3 => “Fines”

- etc..

- Tip: You don’t need to rename the Report Groups if you will only be using Parent Code or Cost Codes hierarchies in the report.

Map Cost Codes to Report Groups:

- An important step in the setup is to map Codes Codes to the Report Groups so that the CC16 – Section A – Receipts & Payments Report knows where to place your transactions. This is a one-time activity. (Note this is not required for the CC16 – Section B – Statement of Assets & Liabilities which has a fixed structure).

- Go to Setup > Cost Codes.

- Switch to Table view and select “Show Parents Only” to simplify the structure.

- Open each Parent Code and assign the appropriate Report Group to each one. Click Save. (Note: Assigning a Report Group to a Parent Code will apply it to all child Cost Codes. You can then adjust individual Cost Codes as needed).

- Tip: If you will only be using Parent Code or Cost Codes hierarchies in the CC16 Section A Receipts and Payments report you can simply map the first Report Group placeholder for each Report Section (A1-A4) to your Cost Codes, as appropriate. You also do not need to rename the Report Group as these will not be shown in the report.

- Tip: When using the Charity set, Payment Cost Codes will display a LE Creditor box (not shown above). This is used to mark a Cost Code as belonging to a “legally enforceable creditor” category.

- If checked, any expense accruals charged to this Cost Code will appear in the Statement of Assets & Liabilities (SOAL) when reporting on a cash basis.

- Normally, short-term creditor balances are excluded from cash-basis reports. However, legally enforceable creditors—such as tax provisions and other statutory liabilities—must be included.

- Tip: If you have any Capital Expenditure (“CAPEX”) Cost Codes, you should map these to the “AX Capex Expenditure (Not in P&L)” Report Group. This will ensure these transactions are excluded from the CC16 Section A Receipts and Payments report.

- Important: Please make sure that all your Cost Codes are mapped to a Report Group. The table view will highlight where these are missing

Run Your CC16 Reports:

Your financial data will now populate the CC16 reports based on your Cost Code mappings, ensuring accurate and compliant reporting.

Go to: Reports > Charity Reports and Financial Statements by Fund

CC16 Section A Receipts and Payments Report

- Select Date Range

- Select Accounting Basis

- Cash: The report will be based on cash-basis only. Receipts & Payments will be included in the period in which they are received or paid only. Transactions made against Creditor and Debtor accounts are ignored.

- Accruals: Select this option to prepare the report based on when the Receipts/Payments were incurred. The report will include all transactions charged to your Creditor and Debtor accounts.

- Please note that when using the Accruals basis, the A6 Cash Funds last year end figure does NOT include Creditor or Debtor amounts. Creditor/Debtors balances are recorded separately in your CC16 SOAL report; however, if you’re trying to reconcile your net funds position, you may need to reference both cash and creditors/debtors together.

- Select Display Options:

- Report Groups: This option will aggregate Receipts & Payments using the custom Report Groups mapped to each Cost Code.

This option gives you the most flexibility and allows you to create an alternative Cost Code structure which can be used by this report. You can rename your Report Groups in Setup > Report Groups, and map them to individual Cost Codes in the Setup > Cost Code page. - Parent Codes: Select this option to aggregate Receipts & Payments at the Parent Code level.

- Cost Codes: Select this option to aggregate Receipts & Payments at the Cost Code level. This is the most granular level report.

- Report Groups: This option will aggregate Receipts & Payments using the custom Report Groups mapped to each Cost Code.

CC16 Section B Statement of Assets and Liabilities Report

- Select Date Range

- Select Accounting Basis:

- Cash: The report will be based on cash-basis only. Receipts & Payments will be included in the period in which they are received or paid only. Transactions made against the Creditor* and Debtor accounts are ignored.

- *Legally Enforceable Creditors: Note that the cash basis should exclude normal trade creditors and accruals, however, it should include “Legally Enforceable Creditor” balances, such as tax provisions, unpaid wages, etc. You can flag individual Cost Codes as Legally Enforceable Creditors to control how these values are shown in the report.

- Accruals: Select this option to prepare the report based on when the Receipts/Payments were incurred. The report will include all transactions charged to your Creditor and Debtor accounts.

- Cash: The report will be based on cash-basis only. Receipts & Payments will be included in the period in which they are received or paid only. Transactions made against the Creditor* and Debtor accounts are ignored.

Report Groups Tutorial

Click the “Full Screen” icon below ![]() to expand. Space bar or Enter to move slides.

to expand. Space bar or Enter to move slides.