Account Opening Balances

For most organisations, setting up your initial Opening Balance is a simple matter of entering the opening balance amounts and dates into your Accounts. You will have already done this for the default Bank Account during the Initial Setup but if you need to change this, or have added more Accounts, then you should do the following:

- If your Account Opening Balance Date is in a prior financial year you will need to temporarily change your Financial Year-End date to an earlier year that includes (or is earlier than) the current and new Opening Date [Setup>Organisation>Financial Year-End].

- Tip: We recommend entering the opening balance date on the last day of the the preceding year to your starting Financial Year.

- Tip: If required, you can setup your Account opening balances at any date during your Financial Year. For instance, if you want to cut-over your accounts to Clubtreasurer half-way through your current Financial Year, say 1-July, just set your opening balance and date as at 30-JUN-XX and start recording transactions on Clubtreasurer from 1st July.

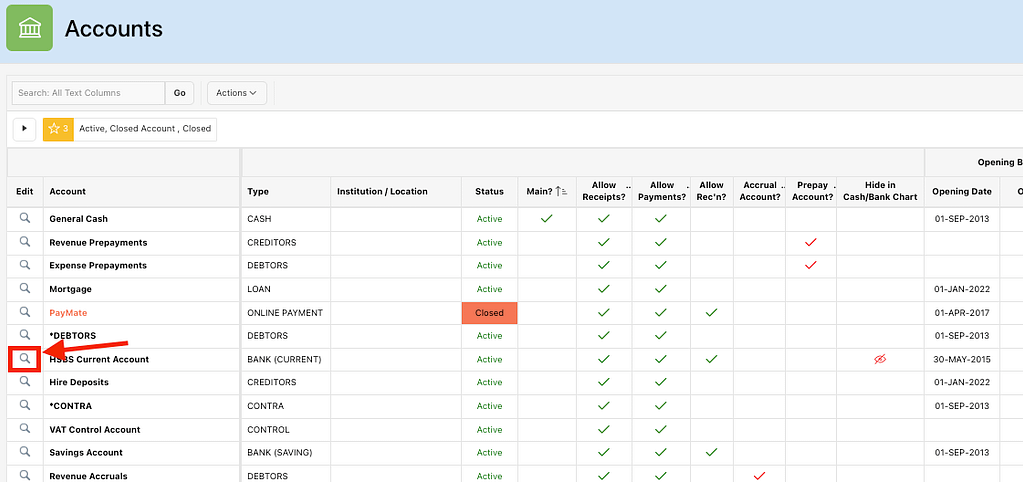

- To change your Account Opening Date and Balance navigate to Setup> Accounts: In the table’s Edit column click the ‘spyglass’ icon for the required Account to open it > Change the opening balance and date as required> Save Changes.

- Reset the Financial Year-End back to the current year.

- This method allocated Opening Balances to your General Fund and General Event

Video: How to Update Account Opening Balance Details

This quick video shows you how to update Account Opening Balance details. It also shows you how to do this where the Opening Balance is Age-Locked from a prior-year. (1:05)

Advanced Opening Balances – Fund & Event Allocations

The simple method above allocates all Opening Account balances to your General Fund and General Event.

If you need to allocate your opening balance to alternative or additional Funds/Events, then you would use the the Funds & Events Transfer (Nav: Transfers > Fund & Event Transfers)

For example, we need the Current Account opening balance (£5000) to be apportioned across Funds as follows:

- General Fund: £2000

- Equipment Fund: £2000

- Charity Fund: £1000

Because the opening balance is already apportioned to the General Fund, we only need to create our Fund Transfer for the Equipment Fund and Charity Fund. (We are not using Events in this example)

- Depending on your setup, you may not see the Account field in the Fund & Event Transfer dialogue. This does not matter as this transfer only records movements between Funds and Events, not Accounts.

Advanced Opening Balances – Prepayments

If your Account opening balances also include expense or revenue prepayments, you will need to set these up in Clubtreasurer using the method described in the Accruals & Prepayments help page.

Importantly, because you will be creating a prepayment transaction(s) against your Bank/Cash Account you must add or deduct the amount, for expenses or revenue respectively, from your Bank/Cash opening balance.