Accounts

Accounts are used to record and manage where your cash is physically held. Examples include your bank accounts as well as general cash balances.

You can also define ‘non-cash’ accounts to record monies due (‘debtors’), monies owed (‘creditors’), offset accounts (‘contra’) and long-term loans.

Most transactions that you record in Clubtreasurer will require you to select an appropriate Account.

Sections

- Managing Accounts

- Creating New Accounts

- Editing Accounts

- Special Account Types

- How to Manage Long-Term Loans

Managing Accounts

There are two main pages you can use to view and edit Accounts and balances:

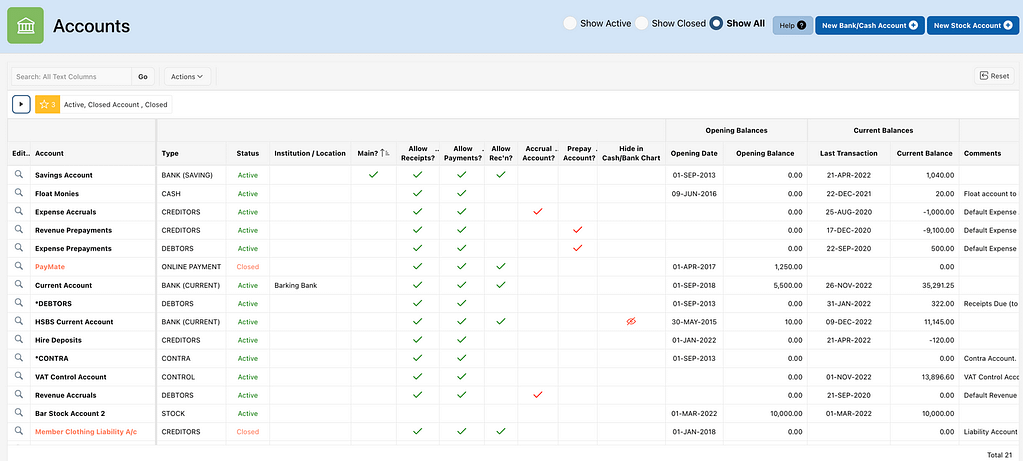

Setup > Accounts

- Menu Path: Setup > Accounts (Financial Managers only)

The Accounts page displays a summary of all your Accounts and is where you view, edit and add new Accounts.

Account Balances

- Menu Path: Accounts > Account Balances

The Account Balance page shows your Accounts and balances grouped in different categories. Finance managers can also add new Accounts and edit Account settings from this page.

- Cash & Bank Account Balances region shows all your cash-based accounts. This region also shows reconciled and unreconciled balances.

- Non-Cash Accounts Balances are all your debtor, creditor, contra and loan accounts.

- Stock Account Balances shows your Stock Accounts and allows you to link to the Manage Stock Accounts page.

- Total Account Balances shows the total net balance for all of your Accounts for the current Financial Year and all future-dated transactions, if any have been entered.

Creating New Accounts

You can create new Accounts from either the Accounts or Account Balances page. Only Finance Managers can create new Accounts.

- Click the New Account button

- Enter the following fields:

- Account (required)

- Enter a user-friendly name for this Account. This is what you will see in the Reports or when you select an Account to create a new transaction.

- Status? (required)

- New Accounts are always set as Active.

- To close (disable) an Account select Closed from the list. This will prevent the Account from being selected for Receipts / Payments and Transfers.

- Closed Accounts will show in all reports.

- You can only close an Account that has no (zero) current balance. Accounts with balances will always be set as Active.

- You can re-open an Account at any time by selecting the Active option.

- Account Type (required)

- Select an appropriate type from the options that best describes your Account. Account Type is used to set certain parameters, such as enabling Financial Institution, allowing bank reconciliations, and also for displaying transactions (see Receipts and Payments)

- Cash Account Types

- CASH

- CURRENT

- CHECKING

- ONLINE PAYMENT

- SAVINGS

- INVESTMENT

- BLDG SOCIETY

- CREDIT CARD

- CLIENT ACCOUNT

- CLIENT ACCOUNTS are a PREMIUM PLUS feature. They enable you to manage and control client funds directly within Clubtreasurer. A key feature of Client accounts is that, during an Account Transfer, you can assign a Receipt/Payment Cost Code to the corresponding transaction, offering enhanced control over fund allocations.

- Non-Cash Account Types

- DEBTOR

- CREDITOR

- Use the DEBTORS and CREDITORS Account Types to create additional accounts receivables and accounts payables Accounts.

- Debtor accounts should have a positive balance

- Creditor accounts should have a negative balance

- Use the DEBTORS and CREDITORS Account Types to create additional accounts receivables and accounts payables Accounts.

- CONTRA

- CONTRA accounts allow you to offset reciprocal Receipt & Payment transactions where no cash transaction occurs. Your Contra account balances should always be zero.

- LONG-TERM LOAN

- Use the LONG-TERM LOAN Account Type to record long-term loans, mortgages, debentures, etc. to be shown as long-term liabiilities on your balance sheet. See below

- Cash Account Types

- Select an appropriate type from the options that best describes your Account. Account Type is used to set certain parameters, such as enabling Financial Institution, allowing bank reconciliations, and also for displaying transactions (see Receipts and Payments)

- Allow Receipts?

- Use this to control whether you want to allow Receipts to be entered against this account. Check the box to allow.

- Not available for DEBTORS / CREDITORS Account Types.

- Use this to control whether you want to allow Receipts to be entered against this account. Check the box to allow.

- Allow Payments?

- Use this to control whether you want to allow Payments to be entered against this account. Check the box to allow.

- Not available for DEBTORS / CREDITORS Account Types.

- Use this to control whether you want to allow Payments to be entered against this account. Check the box to allow.

- Allow Reconciliation?

- Use this to control whether you want to perform bank reconciliations against this account. Check the box to allow.

- You will probably want this for bank, building society and credit card accounts to reconcile your balances and transactions against statements.

- Not available for CASH / DEBTORS / CREDITORS Account Types.

- Financial Institution (CASH; BANK; INVESTMENT;BLDG SOCIETY; CREDIT CARD only)

- Record the Bank, Building Society or other Institution Name for your Account

- Note that Clubtreasurer does not need to hold account/sort-code numbers

- Notes

- Enter notes for this Account.

- Opening Balance and Date

- Record your opening balance value (default 0.00), and date using the calendar popup (default = today).

- Opening Balances and Funds: The opening balance amount is always recorded against your General Fund. You can allocate the opening balance to other Funds by creating a Fund Transfer transaction

- Hide in Cash/Bank Charts

- If you check this box the Account will not be shown in the Cash & Bank Account charts on the Home and Account Balances pages. This allows you to fine-tune these charts by excluding specific accounts, eg. Investment or Reserve accounts to just show liquid cash accounts. This does not effect to All Accounts charts.

- Buttons:

- Save

- Click to save your new Account.

- Save

Editing Accounts

From the Account Balances page click the View/Edit <spyglass icon> to open the View Account page.

The View Account window will open and Finance Managers will be able to click the Edit button.

(The Accounts page will always open to the Edit Account window)

You can make changes to the following fields:

- Account name (required)

- Status? (Not editable when Main Account)

- To close the Account select CLOSED from the drop-down list.

- If you close an Account it will no longer selectable within transaction entry forms. Note that closing an Account does NOT delete or remove transactions.

- You can only close an Account when the current balance is zero.

- Your Main Account must always be active and cannot be changed.

- In the main Accounts page you can toggle between Show Active / Show Closed / Show All view options:

- To close the Account select CLOSED from the drop-down list.

- Account Type (required)

- Allow Receipts?

- Allow Payment?

- Allow Reconciliation?

- Financial Institution (CASH; BANK; INVESTMENT;BLDG SOCIETY; CREDIT CARD only)

- Opening Balance and Date:

- The new opening balance date must be on or before the earliest transaction for this Account.

- Note that Clubtreasurer locks transactions from earlier financial years to protect accidental changes. You may need to temporarily change your Financial Year-End (Setup>Organisation) to update Opening Balance details. (This is shown in the example)

- Hide in Cash/Bank Charts?

- Buttons:

- Save Changes

- Click to save your changes.

- Set as Main Account

- This button sets the Account as your Main Account. The Main Account will be the default Account used in most transaction forms.

- You can only set as the Main Account if the Account:

- Allows Receipts AND Payments

- Status is Active

- Is not a Debtor, Creditor, Contra or Long-term Loan account.

- Delete

- Deletes the Account and removes the Opening Balance transaction.

- You cannot delete an Account that has any other transactions recorded against it (you should set the status as Closed, instead).

- Save Changes

Special Account Types

Debtors and Creditors

Debtor and Creditor Account Types are used to create additional Accounts Receivables (Monies Owed to you) and Accounts Payables (Monies owed by you) accounts.

Editing on Debtor and Creditor Accounts is limited to changing the Account name, Opening Balance details and Notes.

Contra

The Contra Account can be used to offset income and expenditure from the same supplier if no monies were actually exchanged. For instance, you provide a free annual membership to one of your Members in lieu of chargeable services they have provided to your club. No monies will be received or paid in these transaction; however, you would record them as Receipts and Payments against the Contra Account.

Because you offset income and expenditure pairs, the Contra Account balance should always be zero.

You can only edit the Account name, Status and Notes:

Client Accounts

Client Accounts are a special Account Type (Premium Plus only) used to track and manage client monies. It is common for organisations such as Accountancy firms to manage their clients’ accounts on their behalf and often need to receive management fee income directly from the Client Account(s).

When using the Client Account type this can be recorded as part of an Account Transfer.

When using a Client Accounts during an Account Transfer, you can assign a Receipt/Payment Cost Code to the corresponding transaction, offering enhanced control over account/fund allocations If one side of the Transfer is to/from a Client Account you are then able to select a Receipt/Payment Cost Codes for one or both sides of the transfer.

For example, if you need to record a £100 Supplier Payment on behalf of your client and also record a £10 Management Fee income for transacting this, you can do this with the following Account Transfer and Payment transactions as follows:

Account Transfer

- Create a new Account Transfer from the Client A/c for £110 to record the movement of funds out of this Account.

- For recording the Management Fee income you want to transfer monies from the Client A/c to your own Bank A/c and record this an Income in your P&L. You do this with a Transfer-To (see Line 1 in table below) against a Receipt Cost Code.

- For the payment of the Supplier invoice you do not want to show this as an expense on your own P&L, since you are only making the payment on behalf of your client. For this you would add another Transfer-To (see Line 2) and an offsetting Payment transaction.

| TRANSFER | Account | Cost Code | Amount | Description |

| Transfer From | Client A/c | 1820 Transfer to another Account (B/S) | (-110.00) | Move Client A/c funds into Bank A/c for management fees and supplier payments. |

| Transfer To (Line1) | Bank A/c | 4405 Fund Management Fees Income* (P&L) | 10.00 | Receipt of Fund Management income (*Only possible when using a Client A/c) |

| Transfer To (Line 2) | Bank A/c | 7010 Supplier Expense* (P&L) | 100.00 | Record monies into your Bank A/c against an Expense Cost Code – this will be offset by the Payment transaction below (*Only possible when using a Client A/c) |

Payment

- When you make the Client payment from your Bank Account, just record it as a normal Payment Transaction (Note this will offset the Supplier Expense (“receipt”) transfer recorded above).

| RECEIPT/PAYMENT | Account | Cost Code | Amount | Description |

| Payment | Bank A/c | 7010 Supplier Expense* (P&L) | (-100.00) | Record supplier invoice payment from your Bank A/c and same date as the transfer above. Importantly this must use the same Cost Code as in transfer which nets out the expense and so your P&L will not show a (net) cost in your own accounts (ie. £100-£100 = £0) |

Long-Term Loans

Use the Long-Term Loan Account Type to record large, capital loans that your organisation takes out. You will typically record interest payments and capital repayments for the loan – see below.

How to Manage Long-Term Loans

How to Record an EXISTING loan in Clubtreasurer:

- Create your new loan Account:

- Name: “Mortgage‘ (or any name…)

- Account Type: LONG-TERM LOAN – This will create the loan account as a long-term liability.

- Opening Balance: enter opening loan amount as a Negative value if you are bringing an existing loan liability balance into your accounts – you should enter the outstanding loan balance as at the first day you start to record your accounts in Clubtreasurer.

- Record your interest payments as normal Payment transactions from the cash/bank account these are paid from. These will charge your P&L

- Record your capital repayments as an Account Transfer: FROM cash/bank A/c > TO your Mortgage Loan A/c. This will reduce your cash/bank A/c and Mortgage Loan liability A/c balance. The Loan A/c balance will show on the Balance Sheet under Long-Term Liabilities. Capital Repayments are not shown on the P&L.

How to Record a NEW loan in Clubtreasurer:

- Create your new loan Account:

- Name: “Loan‘ (or any name)

- Account Type: LONG-TERM LOAN

- Opening Balance: £0 (see step 2)

- Record your initial loan receipt as an Account Transfer: FROM Loan A/c > TO your cash/bank A/c – this creates the opening loan balance and records the fund deposit into your bank A/c – this will show on the Balance Sheet under Long-Term Liabilities.

- Record your interest payments as normal Payment transactions from the cash/bank account these are paid from. These will charge your P&L

- Record your capital repayments as an Account Transfer: FROM cash/bank A/c > TO your Mortgage Loan A/c. This will reduce your cash/bank A/c and Mortgage Loan liability A/c balance. The Loan A/c balance will show on the Balance Sheet under Long-Term Liabilities. Capital Repayments are not shown on the P&L.