Premium Plus feature: This feature requires a Premium Plus subscription. Trial users have full access to this feature but please note you will need to subscribe to Premium Plus to continue using this after your trial period is over. Existing Premium users can request a new 30-Day trial period for this feature – please raise a Support Ticket.

About Stock Accounts

Stock Accounts are used to record non-cash stock items in Clubtreasurer. Stock Account valuations and valuation changes will appear in your Statement of Assets and Liabilities Reports (Balance Sheet) under “Current Assets”.

If you are using the Cost of Sales accounting method (see below), the period stock cost of sales will be charged to your Profit & Loss Account.

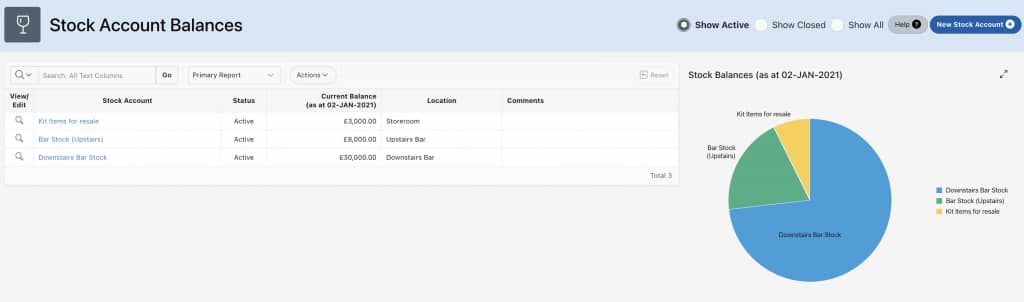

Viewing Stock Account Balances

Navigate to Accounts > Stock Account Balances

(You can also access Stock Accounts from the Account Balances page)

The Stock Account Balances page provides a summary of your stock accounts, including current balances. Use this page to:

- Open Stock Accounts by clicking the Stock Account name or View/Edit icon

- Filter the report to hide/show Active or Closed Stock Accounts

- Create New Stock Accounts

To create a new Stock Account

- Click “New Stock Account“

- Complete the form, include Opening Balance Details

Stock Accounting Methods

You can now choose to manage your Stock accounting either on a Cash-basis or using the Cost of Sales method.

- Cash basis: Stock Addition transactions are treated as normal cash transactions (Payments) and appear as a cost on your Profit and Loss Reports at the time of payment. Cash basis does not take account of how much stock was sold in your reporting period.

- If required, you can manually revalue your Stock. Period Stock valuations will appear on your Statement of Assets & Liabilities / Balance Sheet under ‘Current Assets’.

- the Cash basis method does NOT charge Stock revaluations to your Profit & Loss Account.

- Cost of Sales: With the Cost of Sales method, you enter a period Stock Closing Balance value to generate a Cost of Sale (or Cost of Goods Sold) amount for your Stock. You also associate Sales and Purchase Cost Codes with your Stock Account(s) to enable period Stock surplus/deficit which appears on your Profit and Loss report. This method better reflects the period stock costs used to generate your sales.

Cash Basis Method

To enter Stock Valuation transactions

- Navigate to Accounts > Stock Account Balances

- Click the View/Edit icon or Stock Account name to open the Manage Stock Account page.

- In the Stock Valuation region, click the New Stock Transaction button

- Enter:

- Valuation Details: Accept default or enter a friendly description of the transaction

- Transaction Date

- Type: Select:

- Sales or Disposals*

- Revaluations or Write-downs*

* These are linked to system Cost Codes (Current Assets)

- Valuation Inc/(Dec): Enter valuation increase or decrease (negative amounts for decrease/write-down).

- You cannot enter a write-down (negative) valuation that this higher than the stock balance.

- Importantly, Stock Accounts are used for valuation purposes only to appear in your BS/SOAL reports. They do not affect cash-flows, therefore you should also enter new Payment or Receipt transactions for stock purchase and/or any sales proceeds from stock sales as appropriate.

- You cannot enter a write-down (negative) valuation that this higher than the stock balance.

- Comments: Optional

Cost of Sales Method

To calculate the Cost of Sales amount for your reporting period, you must enter a period closing balance.

- Navigate to Accounts > Stock Account Balances

- Click the View/Edit icon or Stock Account name to open the new Manage Stock Account page

- Click the Edit Account button and associate Sales and Purchase Cost Code(s) with the Stock Account

- Save changes to Close window

- Click Enter Closing Stock Balance button

- Enter Closing Balance Date

- Enter your New Closing Balance valuation for this Stock item and click the “Calculate” button

- The system will generate a Cost of Sales Adjustment value (based on Opening Stock + Stock Additions less Closing Stock.). The system assumes that Stock Additions have already been entered as Payment transactions and the Cost of Sales Adjustment figure corrects your period Stock Cost of Sales amount.

Reports

- Statement of Assets and Liabilities report shows your Stock Account balances under CURRENT ASSETS – OTHER ASSETS